Nervous Markets

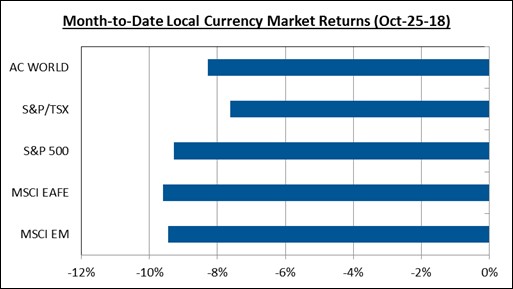

Once again, volatility has reasserted itself at levels not witnessed since the February market rout. Nervous investors have fled indiscriminately from risky assets amid fears that rising interest rates will erode global growth, corporate profits, and equity valuations – while ongoing trade tensions between the world’s two largest economies and tightening financial conditions have also battered sentiment. Notably, investors remain on edge about the prospect of “peak earnings” as the Q3 reporting season gets underway and are paying close attention to the recent spate of profit margin warnings, while gauging how earnings will be impacted in the environment of rising borrowing costs, higher commodity prices, an acceleration in wages, and the impacts from newly imposed tariffs. The rout in equity markets has been fairly broad in nature, with no region left unscathed. More than $6.7 trillion has been swept from global equity values since late September as the world’s major bourses have retreated from their recent highs.

INVESTMENT OUTLOOK & STRATEGY

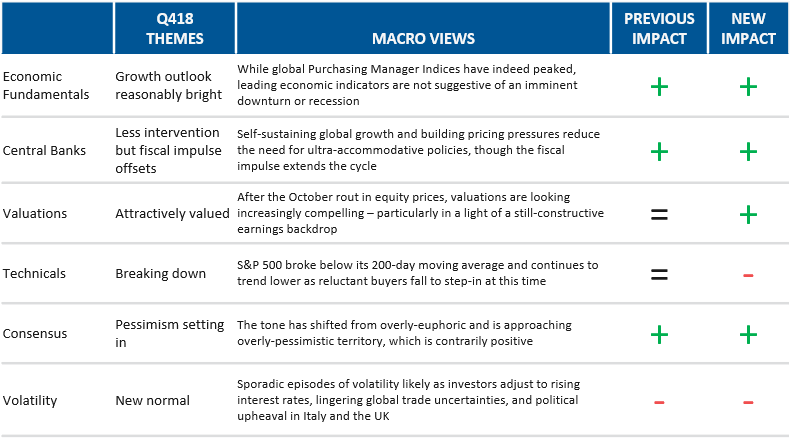

While volatility is surely to prevail as investors adjust to the environment of rising rates, lingering global trade uncertainties, and political upheaval in Europe – the fundamental underpinnings for risk assets remain largely intact over the coming year, in our view. As conditions for a pronounced global economic deceleration and a corresponding recession are all but elusive at this time (until late 2020), we anticipate that this latest market pullback is simply a short-term correction within a cyclical bull market.

- GROWTH: Despite the hostile trading environment, we expect the global economy to continue thriving. Economic momentum remains fairly robust in general, allowing the global economy to absorb higher interest rates and help to alleviate margin pressures.

- CENTRAL BANKS: The fiscal impetus from both the US and China is set to extend the economic upturn into 2019 and provide a buffer as major central banks take coordinated steps towards monetary policy normalization.

- VALUATIONS: Equity multiples have contracted in this sentiment-driven pullback – even as earnings expectations remain elevated.

- SENTIMENT: Overly-optimistic and complacent behaviours have translated into heightened levels of investor angst.

- TECHINICALS: However, in the tumultuous trading backdrop, we have yet to reach a capitulation point. Investors have been reluctant to step back in with a “buy the dip” mentality to date – which argues for ongoing market gyrations in the near-term.

As previously communicated, with volatility comes opportunity. As such, we will be closely monitoring market levels and (barring any new developments on the macro front) would look to re-establish an overweight allocation to global equites if the S&P 500 were to breach the 2550-2600 mark (2%-5% more downside from current levels).

Candice Bangsund, Vice President and Portfolio Manager, Global CIO Office

Click here to download the PDF.

Important Disclosures

Past performance is not a guarantee of future results. Inherent in any investment is the potential for loss.

This document is not intended as investment advice or a recommendation of any security or investment strategy for a specific recipient. Investments or strategies described herein are provided as general market commentary, and there may be no account or fund managed by Fiera Capital Inc. for which investments or strategies described herein are suitable due to the various types of accounts or funds that are managed by Fiera Capital Inc. Nothing herein constitutes an offer to sell, or a solicitation of an offer to purchase, any securities, nor does it constitute an endorsement with respect to any investment area or vehicle. This material is confidential and not to be reproduced or redistributed without the prior written consent of Fiera Capital Inc.

Certain information contained in this document may constitute “forward-looking statements,” which can be identified by the use of forward-looking terminology such as “may,” “will,” “should,” “expect,” anticipate,” “project,” “estimate,” “intend” “continue,” or “believe” or the negatives thereof or other variations thereon or comparable terminology. Due to various risks and uncertainties, actual events or results or the actual performance of any strategy or market sector may differ materially from those reflected or contemplated in such forward-looking statements.

Statements regarding current conditions, trends or expectations in connection with the financial markets or the global economy are based on subjective viewpoints and may be incorrect.

The information provided is proprietary to Fiera Capital Inc. and it reflects Fiera Capital Inc.’s views as of the date of this document. Such views are subject to change at any point without notice. Some of the information provided herein is from third party sources and/or compiled internally based on internal and/or external sources and are believed to be reliable at the time of production but such information is not guaranteed for accuracy or completeness and was not independently verified. Fiera Capital Inc. is not responsible for any errors arising in connection with the preparation of the data provided herein. No representation, warranty, or undertaking, express or implied, is given as to the accuracy or completeness of such information by Fiera Capital Inc. or any other person; no reliance may be placed for any purpose on such information; and no liability is accepted by any person for the accuracy and completeness of any such information.

Any charts, graphs, and descriptions of investment and market history and performance contained herein are not a representation that such history or performance will continue in the future or that any investment scenario or performance will even be similar to such chart, graph or description. Any charts and graphs contained herein are provided as illustrations only and are not intended to be used to assist the recipient in determining which securities to buy or sell, or when to buy or sell securities. Any investment described herein is an example only and is not a representation that the same or even similar investment scenario will arise in the future, or that investments made will be as profitable as such examples or will not result in a loss to any such investment vehicles. All returns are purely historical and are no indication of future performance.

Allocations presented herein are as of the date noted and subject to change. Returns reflect the reinvestment of income and other investment proceeds.

Index Definitions

The Standard & Poor’s 500, often abbreviated as the S&P 500, or just the S&P, is an American stock market index based on the market capitalizations of 500 large companies having common stock listed on the NYSE or NASDAQ.