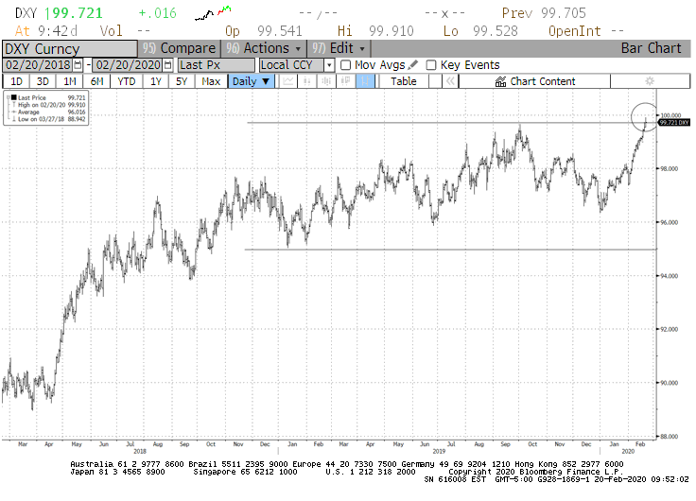

The US Dollar Index (DXY) is probing the top of the trading range we have discussed in recent weeks and is attempting to break out. It’s too early to determine if the dollar is about to initiate a new leg up in this bull cycle for the dollar, but the moment of truth has arrived as we can see in Figure 1. Will a dollar break-out occur, and will it lead to a risk off correction? This comes at an awkward moment for financial markets and the Fed.

Today, The Wall Street Journal announced that the first weeks of 2020 was the biggest issuance period for foreign currency debt by Emerging Markets companies for the start of a year. Issuance in foreign currencies was $66.4 billion, which is almost double the $34.2 billion issued last year. This is a record level of debt issuance for the first weeks of the year and the fall in global rates was a key catalyst for the surge. 91% of this debt issuance was in US Dollars. This highlights the growing risk to Emerging Market nations for a dollar surge. Certainly, a dollar rally does not lead to an EM crisis – the dollar has been going up for years. Yet, traders (particularly in FX and risk markets) often respond to quick unexpected adjustments in the dollar by trimming risk – let’s see if it happens this time as well should a dollar break-out occur. If the dollar breaks out, and there is no risk-off correction – that will be a powerful signal that risk-on investors are highly confident about their positive outlook for earnings and growth.

Especially interesting, is the short-term price action in the dollar shown in Figure 2. The dollar has been going up in recent days, and that rally accelerated with the start of the Democratic Debate in Nevada and accelerated during European hours of trading. Investors and FX traders in Asia and Europe seemed to take the dollar higher in response to the debate and as it has hit the top of the trading range, FX traders in NY morning hours appear to have capped the dollar’s rally. Is the dollar becoming a bet on the Presidential election?

As for the Fed? If the Fed wants inflation over 2%, it cannot afford a stronger dollar. Watch for jawboning from the Fed to talk this currency down.

Figure 1: US Dollar (February 20, 2020)

Bloomberg, data accessed 2/20/20

Figure 2: US Dollar (February 20, 2018 – February 20, 2020)

Bloomberg, data accessed 2/20/20