The National Federation of Independent Business (NFIB), America’s largest small business association, just released a report today that we believe should dispel worry and promote risk-on. The NFIB’s Small Business Optimism Index’s 102.7 level remains near a cycle high, which we believe is a very powerful and positive signal for the economy.

The index has remained elevated despite trade wars, heightened geopolitical concerns, and impeachment. As the charts below show, this signal was also positive during the Clinton impeachment proceedings. In the late 1990’s, small business remained focused on the nuts and bolts of serving clients, building business, and economic data. Just as in the 1990’s, we believe investors today would be wise to follow the signals from Small Business, or risk missing out on a stock rally that continues to climb a wall of worry.

Highlights of the NFIB Small Business Optimism Index report:

• 99% of all firms in the US are small businesses

• These firms represent 97.5% of all exporting firms

• Small business represents 47.3% of all private sector employees and 40.7% of private sector payrolls.

Here is what the NFIB Index is telling us:

• Chart 1: shows the NFIB Index history back to 1990. This index remained elevated throughout the mid to late 1990’s and brushed aside impeachment concerns. Today, it remains elevated, though off its highs.

Source: Bloomberg, 1/4/20.

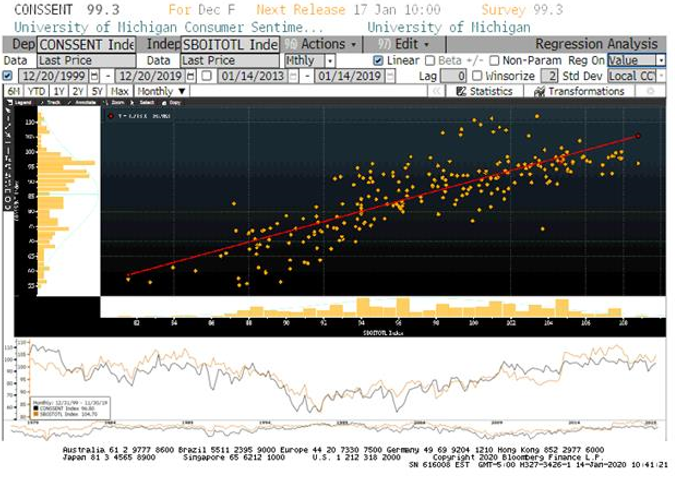

• Chart 2: shows a regression analysis that examines the relationship between Consumer Confidence and the NFIB Small Business Index. Given the number of private sector employees employed by small business, we would expect some relationship. The R-squared is 67%. The conclusion from this simple regression is we should expect consumers to remain confident, and that’s good news for the economy and risk-on.

Source: Bloomberg, 1/14/20.

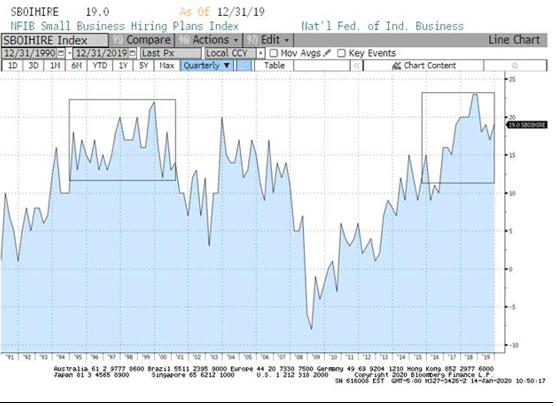

• Chart 3: NFIB’s sub-index components give us insight into future hiring plans. This chart shows that Small Business hiring plans are at the highest levels in 3 decades.

Source: Bloomberg, 1/14/20

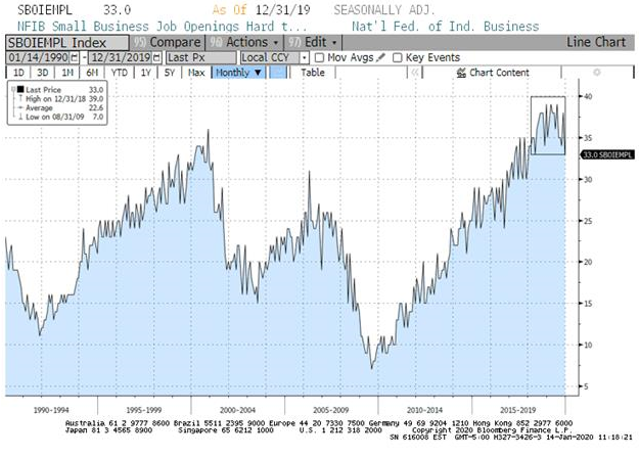

• Chart 4: NFIB’s Jobs Openings Hard to Fill Index is especially informative. It remains near the highest levels on record. Wage push inflation may be in the not too distant future.

Source: Bloomberg, 1/14/20

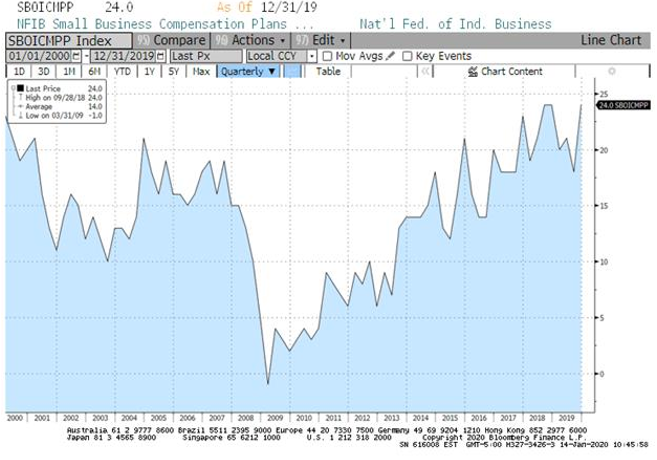

• Chart 5: Given the low unemployment rate, small business expectations for employee compensation are rising as well.

Source: Bloomberg, 1/14/20