IMPORTANT DISCLOSURES

Fiera Capital Corporation is a global asset management firm with affiliates in various jurisdictions (collectively, “Fiera Capital”). The information and opinions expressed herein relate to Fiera Capital’s investment advisory services and investment funds and are provided for informational purposes only. It is subject to change and should not be relied upon as the basis of any investment or disposition decisions. While not exhaustive in nature, these Important Disclosures provide important information about Fiera Capital and its services and are intended to be read and understood in association with all materials available at Fiera Capital’s websites. Past performance is no guarantee of future results. All investments pose the risk of loss and there is no guarantee that any of the benefits expressed herein will be achieved or realized. Valuations and returns are computed and stated in Canadian dollars, unless otherwise noted.

The information provided herein does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. There is no representation or warranty as to the current accuracy of, nor liability for, decisions based on such information. Any opinions expressed herein reflect a judgment at the date of publication and are subject to change. Although statements of fact and data contained in this presentation have been obtained from, and are based upon, sources that we believe to be reliable, we do not guarantee their accuracy, and any such information may

be incomplete or condensed. No liability will be accepted for any direct, indirect or consequential loss or damage of any kind arising out of the use of all or any of this material.

Certain information contained in this document constitutes “forward-looking statements,” which can be identified by the use of forward-looking terminology such as “may,” “will,” “should,” “expect,” “anticipate,” “project,” “estimate,” “intend,” “continue,” or “believe” or the negatives thereof or other variations thereon or comparable terminology. Due to various risks and uncertainties, actual events or results or the actual performance may differ materially from those reflected or contemplated in such forward- looking statements.

Views expressed regarding a particular company, security, industry or market sector should not be considered an indication of trading intent of any funds or accounts managed by any Fiera Capital entity.

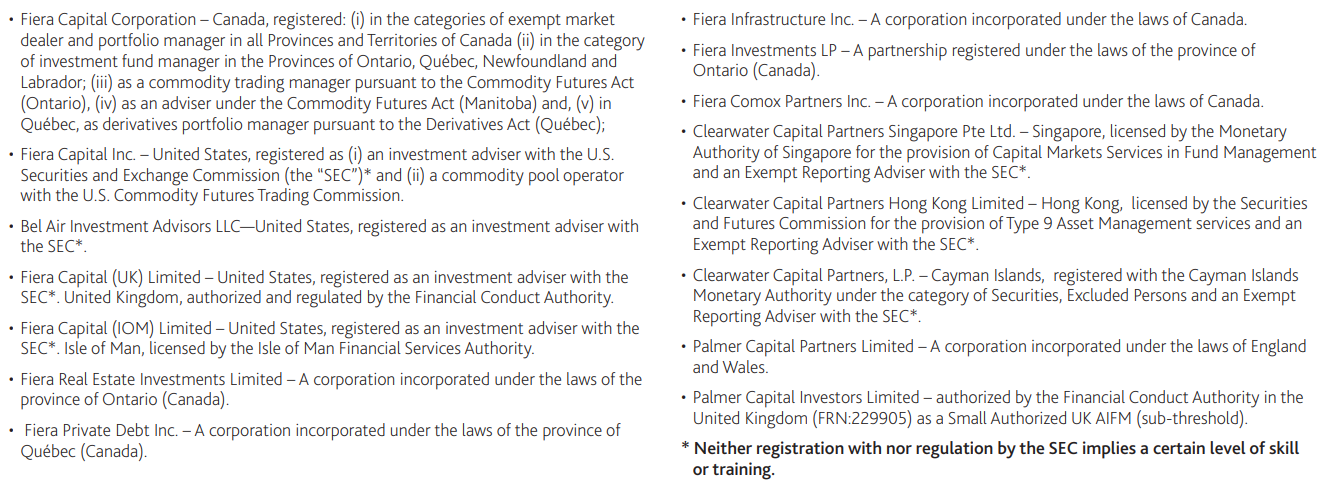

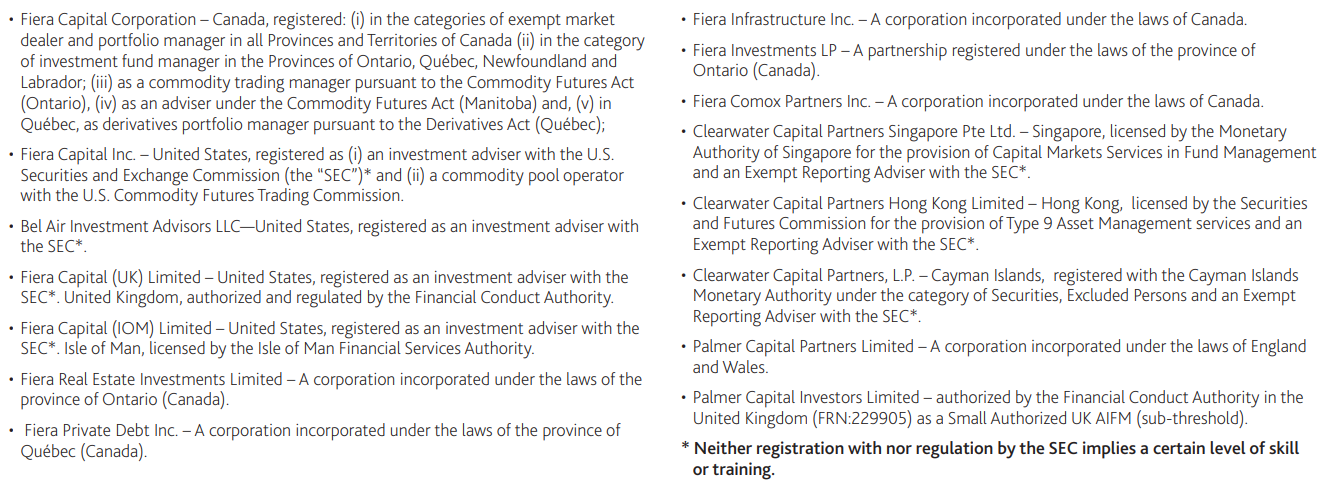

Each entity of Fiera Capital only provides investment advisory services or offers investment funds in the jurisdictions where such member and/or the relevant product is registered or authorized to provide such services pursuant to an exemption from such registration. These include the entities listed below. Where an entity operates under an exemption from registration (the “Exempt Entities”), only its jurisdiction of incorporation is listed. Details on the particular registration and offering exemptions for the Exempt Entities’ activities are available upon request.

Global Asset Allocation Team Market Update – November 2025

The fourth quarter got off to a strong start. Solid economic and corporate earnings results in the United States provided a tailwind for global stock markets – while a tentative trade truce between the United States and China added to the optimistic mood in the market.

Learn more Global Asset Allocation Team Market Update – November 2025