We believe news of renewed talks between the US and China were an important catalyst for a risk-on tone in markets today. Yet, the nuts and bolts fundamentals of the US economy show continued job market strength that is historic, bullish for stocks, bearish for bonds, and good for cheaply valued Treasury Inflation Protected Securities.

Consumers are happy and the wave of mortgage refinancing at today’s lower rates will keep a smile on their face:

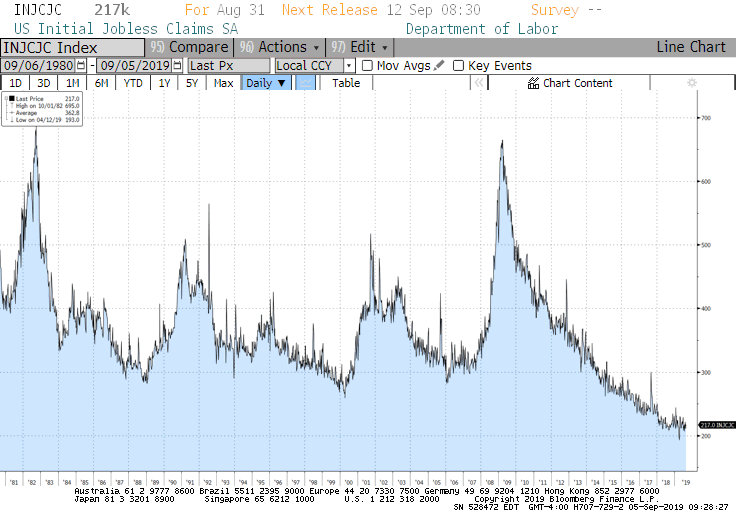

- Today’s report on initial jobless claims shows the jobs market remains extremely strong: jobless claims of 217k remain near the lowest levels in 4 decades (Figure 1).

- As a result, wage gains remain healthy. Unit labor costs rose in the second quarter at a rate of 2.6%, exceeding expectations of 2.4%.

- Consumer Confidence remains at very high levels (Figure 2)

The consumer drives the economy. With wages rising, unemployment low, and the prospect of resumed trade talks, we believe there is reason for markets to take a risk-on breather. And, let’s not forget more pro-consumption mortgage refinancing induced by lower Treasury yields.

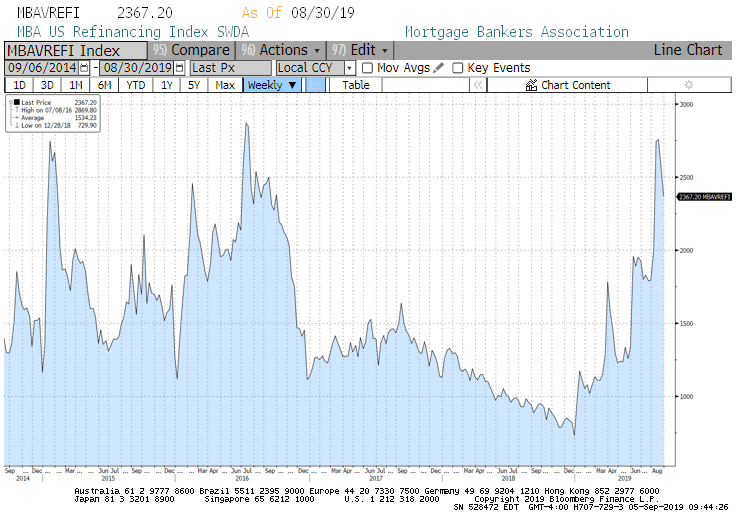

- The Mortgage Banker Association Refinancing Index (Figure 3) has surged in recent weeks in response to lower rates. That puts more money in the pockets of consumers who are already in a good mood.

Here is why we believe it is likely sustainable:

- The US Dollar has been falling in recent days, taking the pressure off of Emerging Market currencies and those developing nations with meaningful amounts of USD debt outstanding.

- FX safe havens like the Swiss franc and the Japanese yen are underperforming today, and risk-on currencies like the Australian dollar and New Zealand dollar are outperforming.

- China’s currency, CNY, has been strengthening – a sign of stability.

- In fixed income, safe haven Treasuries are underperforming, and growth-oriented Treasury Inflation Protected Securities are outperforming.

If maturity prevails in trade talks, and the Fed continues to ease, we believe talk about the yield curve inversion warning flares will fade as a bear steepener in bonds becomes the new investment theme.

Figure 1: US Jobless Claims

Source: Bloomberg accessed 9/5/19.

Figure 2: Consumer Confidence

Source: Bloomberg accessed 9/5/19.

Figure 3: Mortgage Banker Association Refinancing Index

Source: Bloomberg accessed 8/9/19.

Jonathan E. Lewis

Chief Investment Officer

INDEX DEFINITIONS

US Initial Jobless Claims Index tracks the number of people who have filed jobless claims for the first time during the specified period with the appropriate government labor office. This number represents an inflow of people receiving unemployment benefits.

In the United States of America, the U.S. consumer confidence index (CCI) is an economic indicator published by The Conference Board to measure consumer confidence, which is defined as the degree of optimism on the state of the U.S. economy that consumers are expressing through their activities of savings and spending.

The MBA Refinance Index is a weekly measurement put together by the Mortgage Bankers Association, a national real estate finance industry association. The index helps to predict mortgage activity and loan prepayments based on the number of mortgage refinance applications submitted.