We believe yesterday had almost all the ingredients of a risk-off day that favors safe-haven investments, yet one important missing ingredient is a meaningful rally in the US Dollar.

Although the US Dollar looked as though it was threatening to break out of its trading range to the upside last week, it has lost its luster at a curious inflection point for the markets. If the US dollar does not rally when all the other members of the safe haven club are performing well, is there a larger message our FX trading friends are sending us?

- The US dollar (USD) had been moving steadily upward during the last 30 trading sessions as shown in the intraday chart below. It has begun to break down on an intraday basis the past 2 trading days (Chart 1). This strength has suddenly reversed.

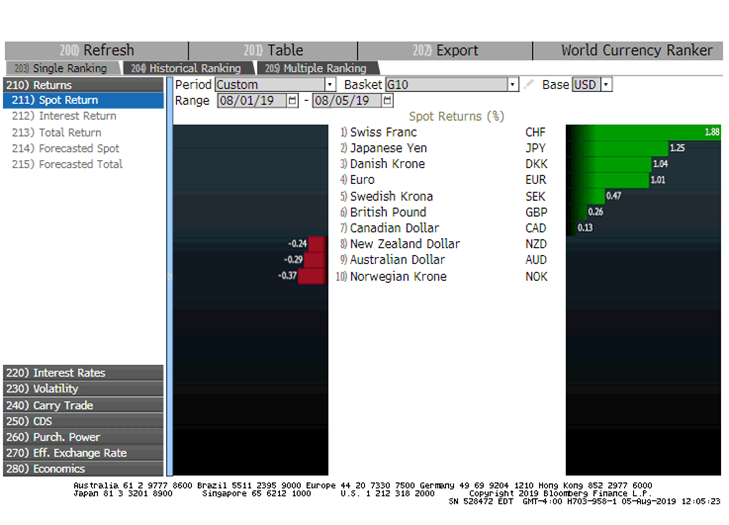

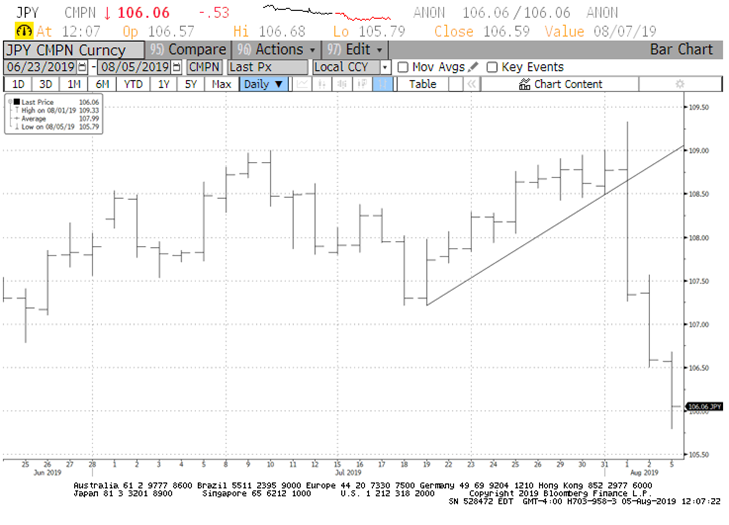

- The USD weakness over the past couple of days is especially notable against major safe-havens in the G-10 space like the Swiss franc, the Japanese yen, and the Euro (Chart 2). A close-up of the Japanese yen shows how significant the move has been (Chart 3).

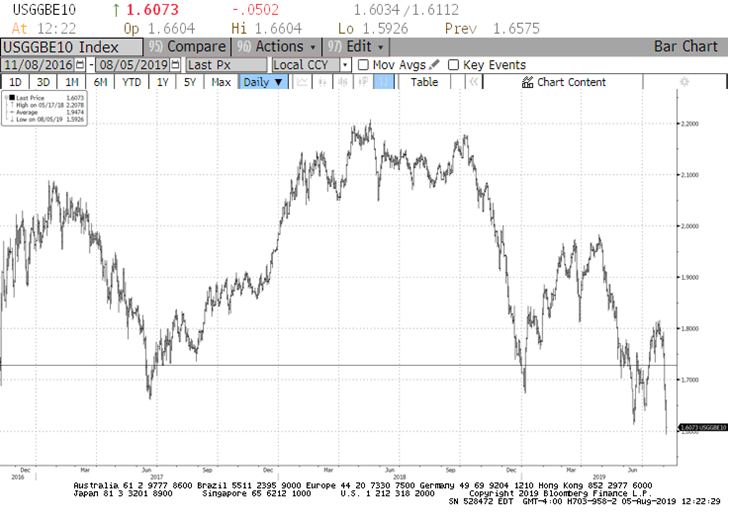

- Importantly, the gold rally has accelerated in recent days (Chart 4). While gold can shape shift between safe-haven and inflation hedge, in recent days it is clearly a safe-haven. The market’s long-term view of inflation is fading fast. This can be seen in break-even inflation rate of 10-year TIPs – which is falling at a rapid rate.

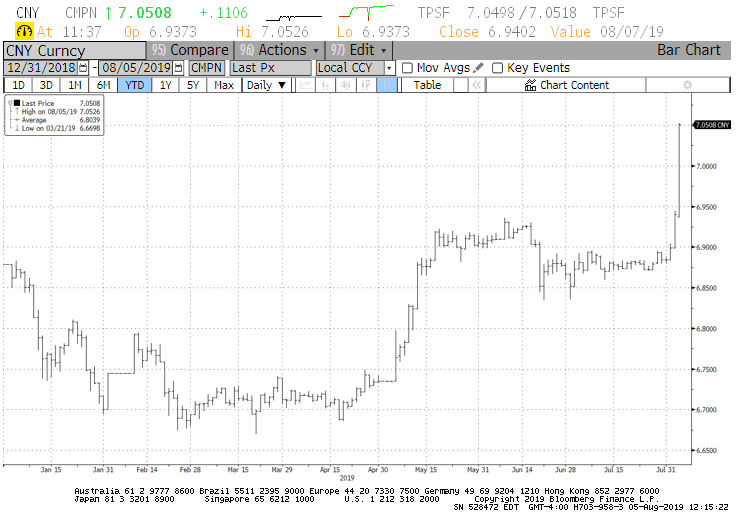

- Adding to the list of market indicators flashing warning signs yesterday included a flatter yield curve, wider corporate spreads, and another FX indicator, Chinese yuan (CNY) (Chart 4). China has allowed the CNY to weaken through the significant 7 level, thus far in an orderly manner, but an important indicator to track none the less. If trade talks do not resume, we expect more CNY weakness. We believe the market can handle an orderly weakening, something more dramatic would be a greater challenge.

Is this the beginning of a larger risk-off trade? Or, is this possibly the beginning of a correction that will cure itself as investors focus on the economic fundamentals?

- Thus far, we believe this has all the hallmarks of a risk-off trade, not a new longer-term trend. This feels like a thunderstorm that clears the skies, not the beginning of something much larger regime change. The absence of any real safe-haven move in the dollar is an important market-based indicator to watch to confirm this view. True, the dollar has moved up against the usual EM currencies, but not in a manner that is destabilizing – yet.

- Major stock indices remain above key technical support levels (i.e. 200 day moving averages).

- Earnings have been healthy.

- Though economic indicators like yesterday’s ISM Services may have decelerated, they remain in healthy growth territory.

- The Fed has actually begun to ease.

- And, the Fed has served notice to the world it is watching market-based indicators of inflation and it will likely continue to ease, perhaps aggressively, to fight falling inflation expectations.

Which leads to the most important chart of the day:

When President Trump was elected President, inflation expectations rose in anticipation of tax cuts and infrastructure spending, amongst other growth-oriented policies. As Chart 5 shows, in recent days inflation expectations have fallen to levels not seen since before his election. The consequence? We expect the Fed to ease, and the Executive Branch to focus on pro-growth investments.

US Dollar

Source: Bloomberg accessed 8/5/19.

G-10 Returns

Source: Bloomberg accessed 8/5/19.

Japanese Yen

Source: Bloomberg accessed 8/5/19.

Chinese Yuan

Source: Bloomberg accessed 8/5/19.

10-Year TIPS Breakevens

Source: Bloomberg accessed 8/5/19.

Jonathan E. Lewis

Chief Investment Officer