RECAP: Financial Market Fragility

The month of August has been an eventful one to say the least. Sentiment remains extremely fragile and investors have been unnerved by several worrisome developments on the macro front. The Federal Reserve kicked things off in late-July and disappointed after cutting interest rates (as expected) but failed to succumb to the market’s ultra-dovish bias and instead referred to the move as a “mid-cycle adjustment” (rather than the beginning of a new easing cycle). Immediately following was a re-intensification in the trade debacle, where President Trump announced a 10% tariff on the final $300 billion of Chinese imports effective September 1st. China retaliated immediately by halting US agricultural purchases, while the yuan fell below the sacrosanct 7 per dollar level. However, in a surprise announcement on August 13th, Mr. Trump reversed course and stated that “some” of the tariffs would be averted until December, while negotiations are set to resume in the coming weeks. In between, hints of global economic softness on top of geopolitical flare-ups in Hong Kong, Argentina, and Italy have plagued an already-fragile backdrop.

Not surprisingly, volatility has resurfaced in response and financial markets have been whipsawed, with investors fleeing to safe haven assets such as bonds and gold, while equities and other risky assets have taken the brunt of the weakness. Of note, bond yields have been pummeled across the globe with the biggest moves taking place in the long-end of the curve. As a result, yield curves have flattened substantially and in some cases inverted, which has further fueled growth concerns and stoked recession fears. Interestingly, this profound downward move in bond yields has become self-fulfilling in that nervous investors have moved even more aggressively into bonds in response, which has further accentuated the downward move.

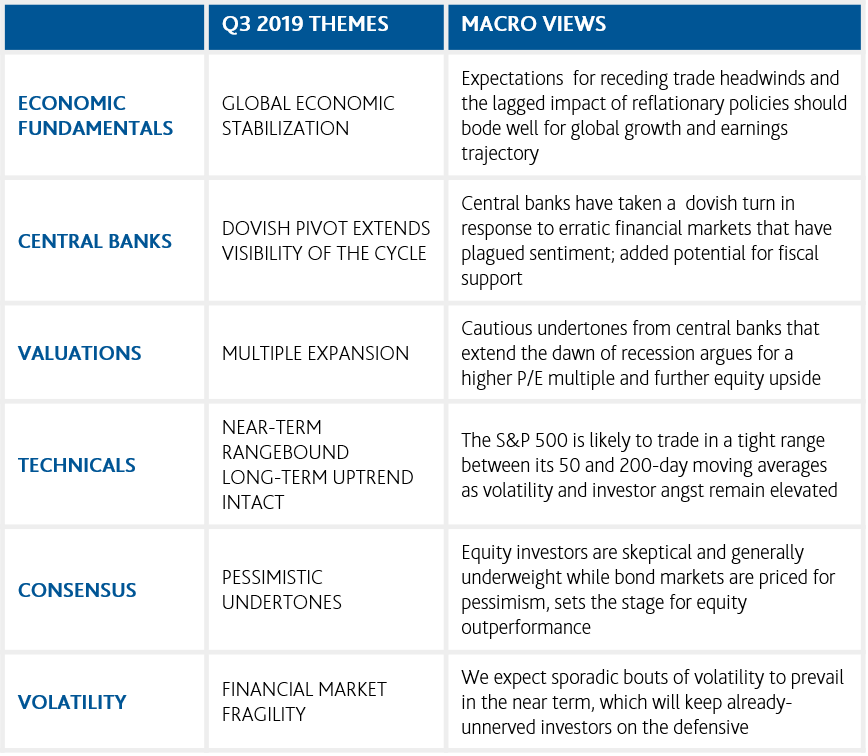

Outlook & Investment Strategy

It goes without saying that tensions on the trade-front are likely to linger-on over the coming months, with the flurry of trade-related headlines likely to provoke vulnerable investors and ignite periodic bouts of volatility. However, looking further out we expect fundamentals to prevail and to drive a corresponding recovery in risk appetite during the second half, should the plethora of reflationary efforts from central banks prove successful in reinvigorating growth. As such, we would resist the temptation to panic and recommend staying invested at this time, with a preference for stocks over bonds over the next 12 months.