The Conundrum

The Number:

The most recent jobs report of 300k was an eye-opener, as was November’s upward revision by over 50,000 jobs, to 176,000. Nevertheless, the consensus outlook for the economy has seemed inordinately tied to the mood of the stock markets, rather than economic data. Given that most of the underlying fundamentals of the economy remain sound, why the disconnect with stock movements? It has been a long-held notion that the stock market is a good predictor of where the economy is headed. Repeatedly debunked, it still resides in the back of investors’ minds. But clearly, the recent weakness in the stock market isn’t a reflection of weak economic activity, even looking forward. It’s more likely the by-product of a contractionary monetary policy that seeks to reverse the support that Quantitative Easing delivered to asset prices and the economy in the prior year.

The Conundrum:

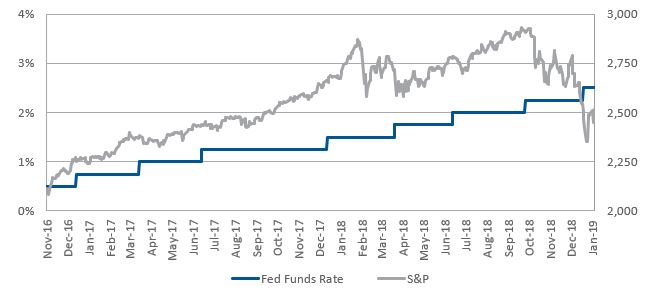

The sheer sizes of the December number and the November revision have important implications. Since it is still conventional wisdom that tighter labor markets lead to higher wages which then leads to higher inflation (despite the absence of convincing evidence), we expect that the Fed will continue its efforts to tighten further either with more hikes, further shrinking its balance sheet holdings, or a combination of the two. Continuation of contractionary monetary policy, or quantitative tightening, implies a repeat of the sequence where stock prices rally on economic activity (as in January and September), only to fall again (as in February and October) as money dries up. So, Friday’s good news might be its own undoing.

The S&P 500 has fallen each Fed rate hike this year

Source: Bloomberg, accessed 1/4/19

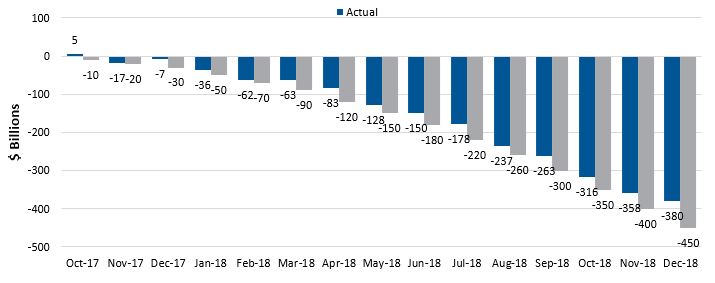

Fed Balance Sheet Reduction Process

Source: Bloomberg, accessed 1/4/19

Addendum: Speaking at the Economics Club in Washington, DC today, Chairman Powell reiterated his view that the US economy is strong, but that he has concerns about China and Europe. Additionally, he warned that a long government shutdown would eventually have a negative impact on the US economy. But it was his contention that the Federal Reserve’s balance sheet should be “substantially smaller’ than it is now -essentially reiterating the Fed’s quantitative tightening policy, that seemed to rattle the markets. Just after the comment, stocks turned lower, US Treasury yields inched downward, and oil prices dropped.1 While Powell did not provide any specifics regarding how much smaller that would be, he said that that he expected the balance sheet to be “smaller than it is now, but nowhere near where it was before.”2 The market seems to be recognizing that the monetary contraction that would result from further shrinkage of the balance sheet would have a noticeably negative impact on economic growth and corporate profits.

Joseph A. Abraham, CFA

Senior Vice President, Direct Client Investments

Important Disclosures

Past performance is not a guarantee of future results. Inherent in any investment is the potential for loss.

Past performance is not a guarantee of future results. Inherent in any investment is the potential for loss. This document is not intended as investment advice or a recommendation of any security or investment strategy for a specific recipient. Investments or strategies described herein are provided as general market commentary, and there may be no account or fund managed by Fiera Capital Inc. for which investments or strategies described herein are suitable due to the various types of accounts or funds that are managed by Fiera Capital Inc. Nothing herein constitutes an offer to sell, or a solicitation of an offer to purchase, any securities, nor does it constitute an endorsement with respect to any investment area or vehicle. This material cannot not to be reproduced or redistributed without the prior written consent of Fiera Capital Inc. Certain information contained in this document may constitute “forward-looking statements,” which can be identified by the use of forward-looking terminology such as “may,” “will,” “should,” “expect,” anticipate,” “project,” “estimate,” “intend” “continue,” or “believe” or the negatives thereof or other variations thereon or comparable terminology. Due to various risks and uncertainties, actual events or results or the actual performance of any strategy or market sector may differ materially from those reflected or contemplated in such forward-looking statements. Statements regarding current conditions, trends or expectations in connection with the financial markets or the global economy are based on subjective viewpoints and may be incorrect. The information provided is proprietary to Fiera Capital Inc. and it reflects Fiera Capital Inc.’s views as of the date of this document. Such views are subject to change at any point without notice. Some of the information provided herein is from third party sources and/or compiled internally based on internal and/or external sources and are believed to be reliable at the time of production but such information is not guaranteed for accuracy or completeness and was not independently verified. Fiera Capital Inc. is not responsible for any errors arising in connection with the preparation of the data provided herein. No representation, warranty, or undertaking, express or implied, is given as to the accuracy or completeness of such information by Fiera Capital Inc. or any other person; no reliance may be placed for any purpose on such information; and no liability is accepted by any person for the accuracy and completeness of any such information. Any charts, graphs, and descriptions of investment and market history and performance contained herein are not a representation that such history or performance will continue in the future or that any investment scenario or performance will even be similar to such chart, graph or description. Any charts and graphs contained herein are provided as illustrations only and are not intended to be used to assist the recipient in determining which securities to buy or sell, or when to buy or sell securities. Any investment described herein is an example only and is not a representation that the same or even similar investment scenario will arise in the future, or that investments made will be as profitable as such examples or will not result in a loss to any such investment vehicles. All returns are purely historical and are no indication of future performance.

Sources: 1. (BN) Stocks Fall During Powell Remarks on Balance Sheet: Markets 2. https://www.cnbc.com/2019/01/10/powell-says-balance-sheet-will-be-substantially-smaller.html