The Battle Between T-bills and the 2-year note: Fed Tightening is likely over, pause or easing cycle likely ahead

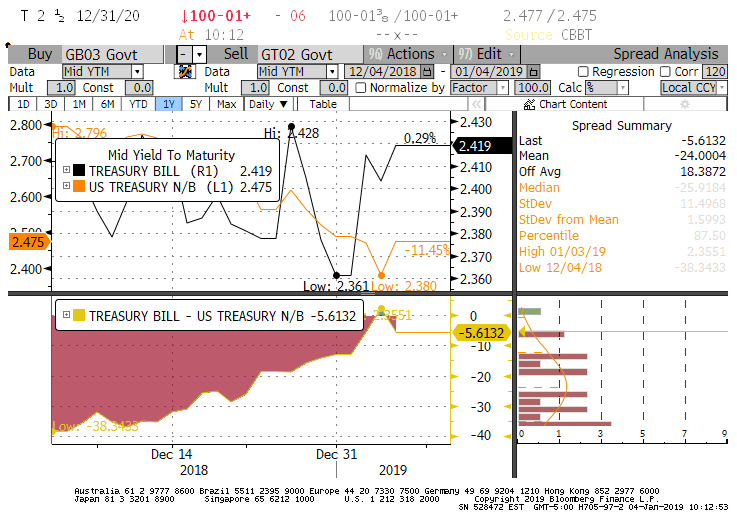

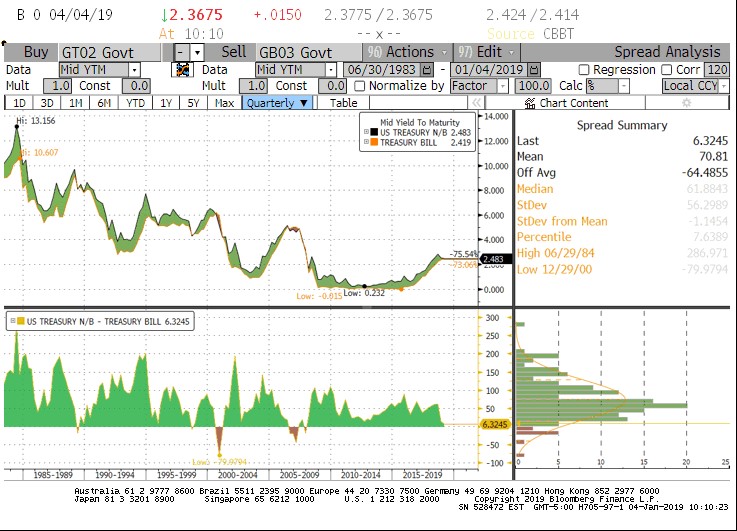

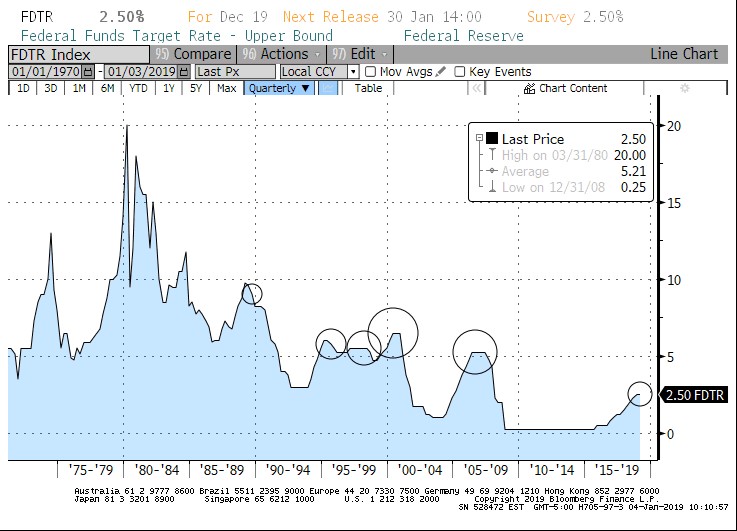

If all we know about markets was based on the relationship between T-bills and the 2-year note, we have arrived at an important junction. T-bills and the 2-year note are battling over whether or not the front end of the yield curve will be positive, or inverted (Chart 1). In some ways, this battle is already over as far as the rest of the market should be considered. It is very rare for the relationship between T-bills and the 2-year note to be this flat or inverted. As Chart 2 shows this has only occurred a handful of times since the early 1980’s – when the Fed is raising rates and monetary policy is getting tighter. The significance for investors today is that when it occurs, the Fed is usually on the verge of a pause in the rate hike cycle, or an easing cycle is about to begin. On the surface this would appear to be favorable for risk assets – in the majority of cases risk assets have tended to do well after the tightening cycle has paused or ended – but not always. The exceptions to this rule were pretty bad (think 2000 and the set-up for the 2008 financial crisis). Nonetheless, there is cause for optimism today – the world has many notable and obvious challenges, but the excesses that existed in the markets in 2000 and in the years right before the 2008 Financial Crisis are not apparent today. If a pause or an easing cycle is before us, it is more likely to favor risk-on trades rather than risk-off trades.

1 and 2 Year Treasuries

Source: Bloomberg, accessed 1/4/18

1 and 2 Year Treasuries – Historical

Source: Bloomberg, accessed 1/4/18

Federal Funds Target Rate

Source: Bloomberg, accessed 1/4/18.

Jonathan Lewis

Chief Investment Officer

Important Disclosures

Past performance is not a guarantee of future results. Inherent in any investment is the potential for loss.

This document is not intended as investment advice or a recommendation of any security or investment strategy for a specific recipient. Investments or strategies described herein are provided as general market commentary, and there may be no account or fund managed by Fiera Capital Inc. for which investments or strategies described herein are suitable due to the various types of accounts or funds that are managed by Fiera Capital Inc. Nothing herein constitutes an offer to sell, or a solicitation of an offer to purchase, any securities, nor does it constitute an endorsement with respect to any investment area or vehicle. This material cannot not to be reproduced or redistributed without the prior written consent of Fiera Capital Inc.

Certain information contained in this document may constitute “forward-looking statements,” which can be identified by the use of forward-looking terminology such as “may,” “will,” “should,” “expect,” anticipate,” “project,” “estimate,” “intend” “continue,” or “believe” or the negatives thereof or other variations thereon or comparable terminology. Due to various risks and uncertainties, actual events or results or the actual performance of any strategy or market sector may differ materially from those reflected or contemplated in such forward-looking statements.

Statements regarding current conditions, trends or expectations in connection with the financial markets or the global economy are based on subjective viewpoints and may be incorrect.

The information provided is proprietary to Fiera Capital Inc. and it reflects Fiera Capital Inc.’s views as of the date of this document. Such views are subject to change at any point without notice. Some of the information provided herein is from third party sources and/or compiled internally based on internal and/or external sources and are believed to be reliable at the time of production but such information is not guaranteed for accuracy or completeness and was not independently verified. Fiera Capital Inc. is not responsible for any errors arising in connection with the preparation of the data provided herein. No representation, warranty, or undertaking, express or implied, is given as to the accuracy or completeness of such information by Fiera Capital Inc. or any other person; no reliance may be placed for any purpose on such information; and no liability is accepted by any person for the accuracy and completeness of any such information.

Any charts, graphs, and descriptions of investment and market history and performance contained herein are not a representation that such history or performance will continue in the future or that any investment scenario or performance will even be similar to such chart, graph or description. Any charts and graphs contained herein are provided as illustrations only and are not intended to be used to assist the recipient in determining which securities to buy or sell, or when to buy or sell securities. Any investment described herein is an example only and is not a representation that the same or even similar investment scenario will arise in the future, or that investments made will be as profitable as such examples or will not result in a loss to any such investment vehicles. All returns are purely historical and are no indication of future performance.