Investment Approach

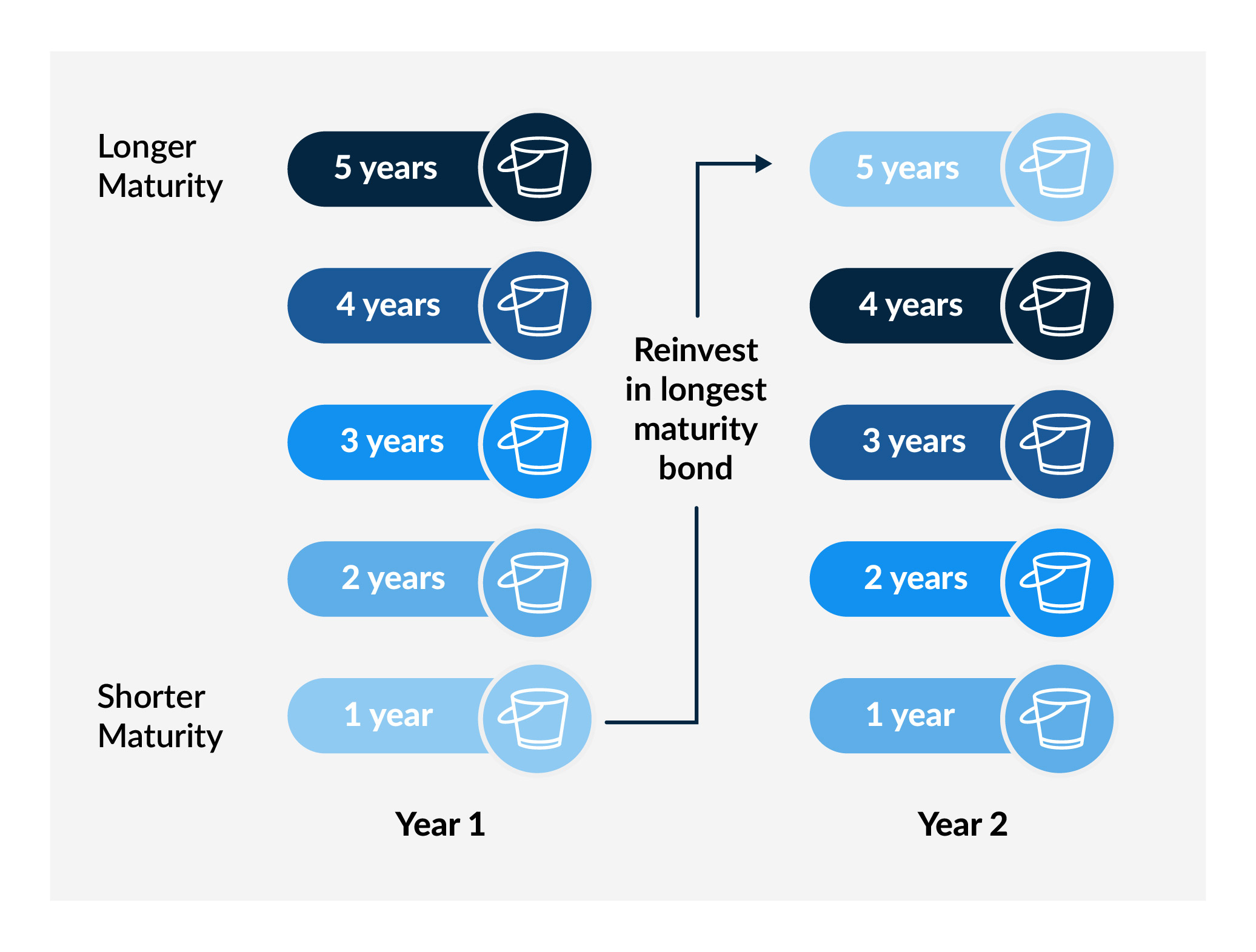

Designed for changing market environments, our ladder approach provides interest rate neutral investment through staggered maturities that consistently reinvest in changing rate environments. Our laddered tax efficient fixed income strategies offer predictable income and reinvestment while optimizing after-tax returns.

Key Features of Our Bond Ladder Solutions:

- Tax Optimization

- State-Specific Customization

- Tax-Loss Harvesting

- BBB Customization

- Low Minimums and Fees

- Trade Execution